Aug 7, 2025

Grid Bot in Crypto Trading — Advantages, Risks, and Critical Analysis

Learn how grid bots work, what their real pros and cons are, and why frozen capital, misleading ROI stats, and lack of SLs make them risky. Discover smarter alternatives like Intralogic Backtesting Bot.

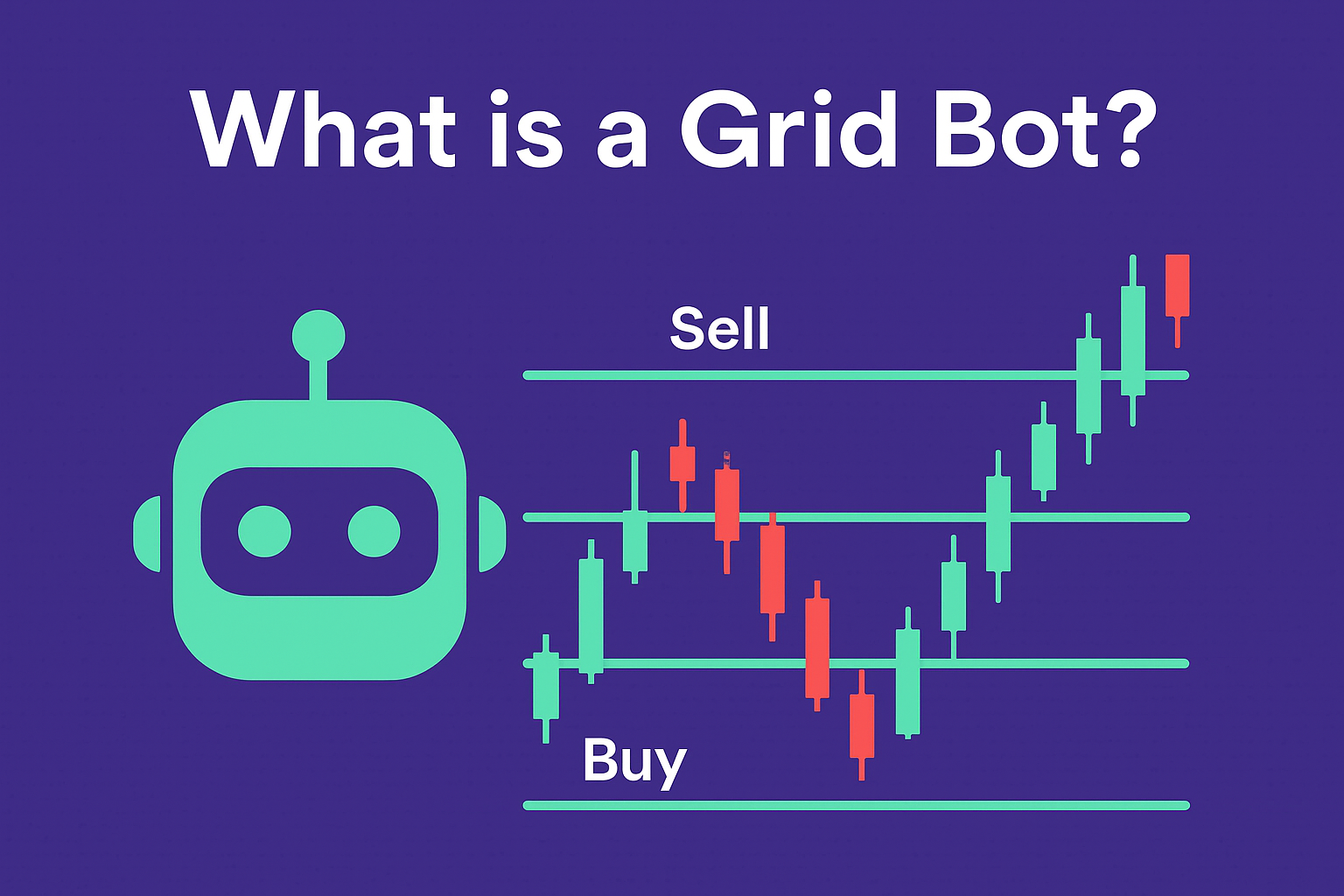

What is a Grid Bot and How Does It Work?

A grid bot is an automated trading system that places a grid of buy and sell orders at different price levels. For example, if Bitcoin trades at $112,000, the bot can place orders between $105,000 and $119,000 at fixed intervals (say, every 1%).

The bot doesn’t buy coins immediately — it places limit orders in the order book. As price drops, the bot buys lower; as price rises, it sells higher, locking in small profits. This strategy works best in bull markets or sideways trends where price oscillates within a range.

Advantages of Grid Bots

Profits in Sideways and Bull Markets

Grid bots thrive in environments where price fluctuates predictably. They capitalize on every short-term dip by buying low and selling high — often making many small but consistent profits, like 1% per trade.

Easy to Set Up and Widely Available

Grid bots are easy to understand even for beginners. You define the price range, number of grid levels, and set your take-profit (TP) and optional stop-loss (SL). Many crypto exchanges offer prebuilt grid bots or allow users to copy strategies from others.

Automation Saves Time

Grid bots run 24/7, removing the need to constantly monitor charts. They eliminate emotional trading and allow for fully passive strategies.

Disadvantages and Risks of Grid Bots

Frozen Capital and "Bagholding"

The biggest risk of grid bots is prolonged price drops. The bot keeps buying as price falls, using up available capital. Eventually, you're left holding multiple open positions deep in the red — known as “bagholding” or “frozen capital.”

Higher Risk with Altcoins

Altcoins often don't recover after big drops — especially those with low volume or hype-driven rallies. Worse, some get delisted from exchanges, forcing users to sell at a loss. That makes grid bots dangerous when used on anything but top-tier coins.

Poor Long-Term Efficiency

Even with 1% profit per trade, you may wait months to recover from deep drawdowns. Holding assets like BTC or ETH, which tend to break all-time highs, can often be more profitable in the long run.

No Advanced Market Analysis

Grid bots use basic logic — they don’t adapt to changing market conditions or apply advanced technical indicators. They might seem effective at first, but eventually struggle when the market exits a range or trends sharply.

Copy Trading Problems and ROI Manipulation

Misleading ROI and WinRate

Copying bots from other users often means relying on questionable performance stats. ROI is frequently calculated on the original deposit, not the real invested capital — leading to inflated 100%+ monthly returns.

WinRate is also often faked by hiding open losing positions. Many grid bots avoid SLs to keep WinRate at 100%, but that just hides the risk of massive unrealized losses.

Lack of Stop-Losses

Many grid bot users avoid using SLs entirely — since closing a losing position would ruin their stats. But this leads to frozen capital and long-term underperformance.

Why Do Exchanges Promote Grid Bots?

Grid bots create high trading volume — and more trades mean more fees for exchanges. That’s why exchanges love to offer easy-to-use grid bots. More advanced bots that trade less frequently and rely on analysis generate fewer fees and are promoted less.

Final Thoughts: Should You Use a Grid Bot?

Grid bots can work during sideways or mild bull markets. But their limitations — frozen capital, lack of adaptability, misleading stats, and no SLs — make them risky in the long run.

Instead of relying on static grid strategies, it's worth exploring solutions that adapt dynamically to market phases using real historical data.

Looking for a smarter alternative to grid bots?

Ditch the static TP/SL grids and try Intralogic Backtesting Bot — an advanced system that automatically adjusts its parameters based on historical trends and current market behavior. No need to manually set grids — it intelligently finds what works and executes accordingly.

READ MORE